Investment & Ownership of Precious Metal

Short guide by Sequoyah Wealth Management

- Open an account with us today and enjoy access to the LBMA & LPPM markets

- All metals are stored physically in our vaults in Denmark, Germany or Switzerland

- Scandinavia’s most competitive rates. Full liquidity guaranteed with value date = trade day

Precious metal is one of the oldest asset types available.

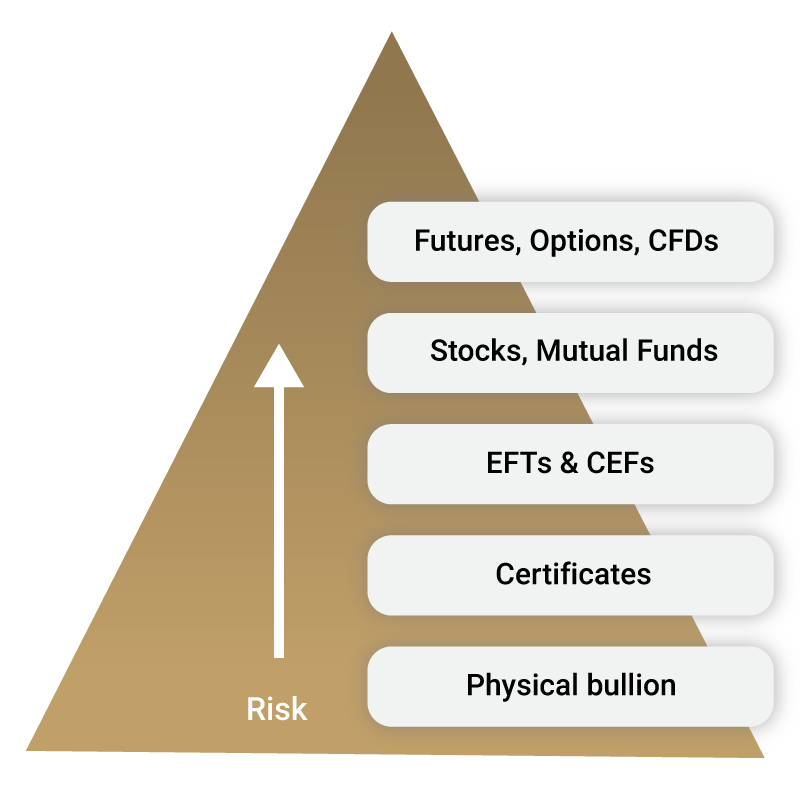

Today it can be owned in a number of ways – each with its own characteristics. In broad strokes, there are two ways to invest in precious metals – Paper or Physical. ‘Paper’ being a broad term for financial instruments with precious metals as an underlying asset, i.e. futures, options, shares, ETFs etc., and all of these are traded at Exchanges. ‘Physical’ refers to owning the actual metal (bullion) itself. Both can be an equally efficient part of your strategy, but characteristics vary from instrument to instrument. As with other asset classes the different characteristics are essential to be aware of. All precious metals can be great assets if correctly implemented in your strategy, but it can also end up doing more harm than good if mishandled. The figure below is often used to give a brief overview of the many ways that gold can be traded.

The choice of metal instrument should reflect your overall investment strategy, for instance growth vs. preservation, and priorities such as succession planning or similar. At Sequoyah Wealth Management we will be happy to discuss the various ways you can incorporate metals in your investment strategy

Investing in gold? Get our investment guide for gold today.

The subject of this guide is gold as an investment.

As an entity that holds a monetary value, and which is capable of creating increased value and decreased economic risks. Or the opposite, for someone who doesn’t know what they’re getting into.

Get 21 pages with the following keypoint: Futures and options contracts, Mining shares and stocks, Exchange-traded funds, Closed-end funds, Certificates, Coins, Bars, Physical gold and professional storage.

We do use your information to send newsletters, but maybe we will contact you for further interest to our products.

Contact Sequoyah Wealth Management

If you wish to speak to a MiFID II certified Investment Advisor, let us know and we will contact you